The New ‘Taylor Swift Tax’ Targets The Wealthy

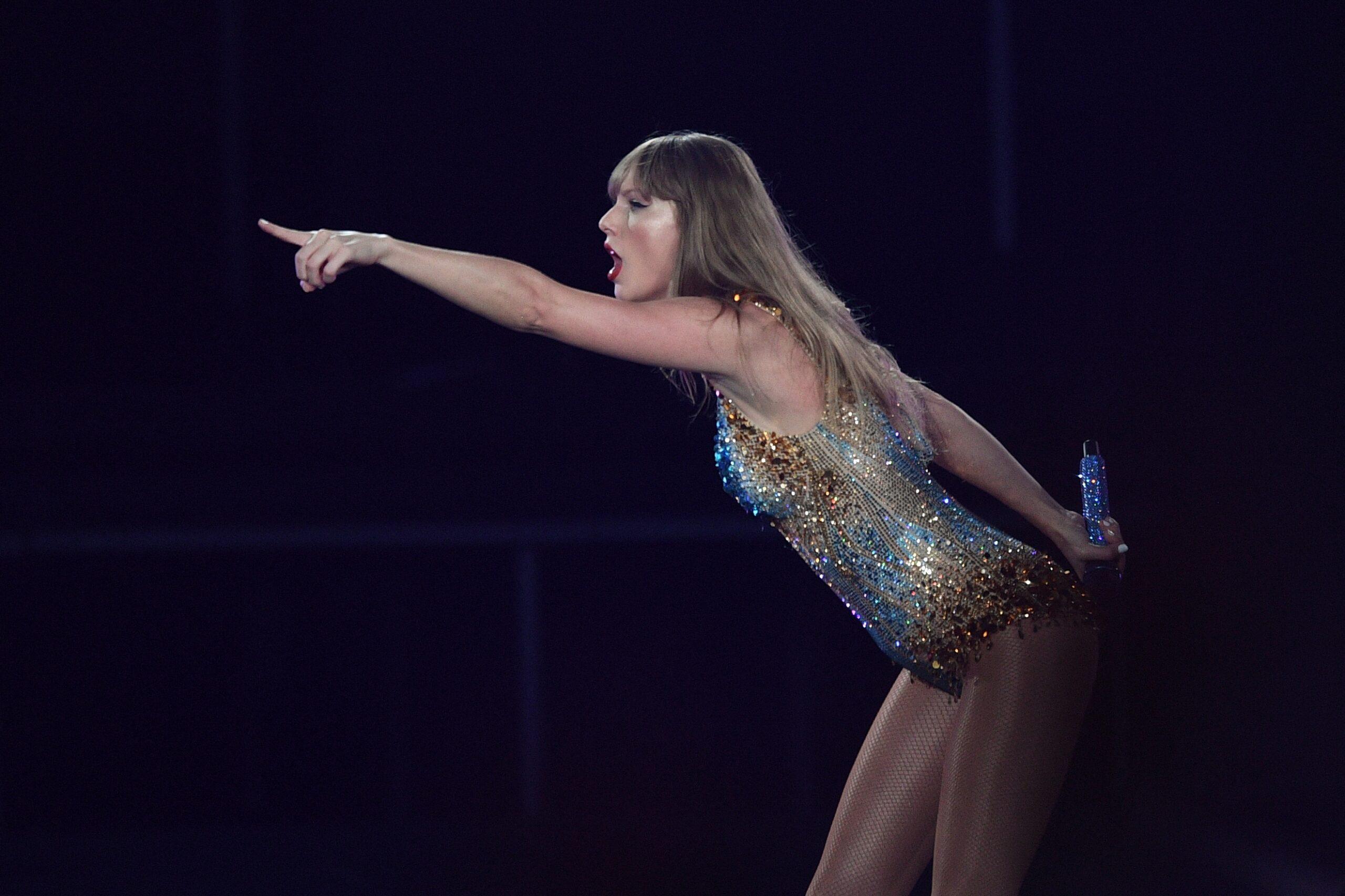

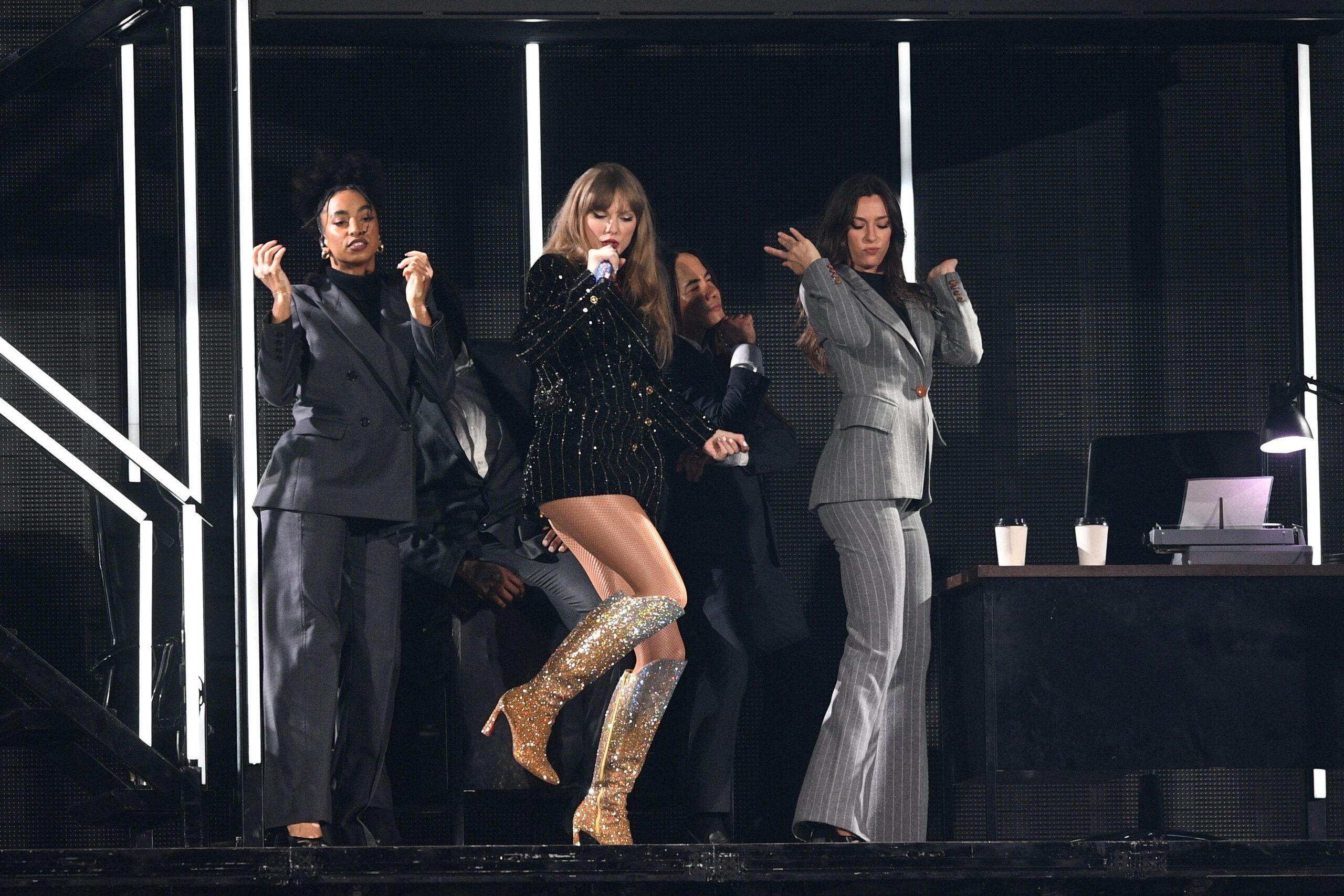

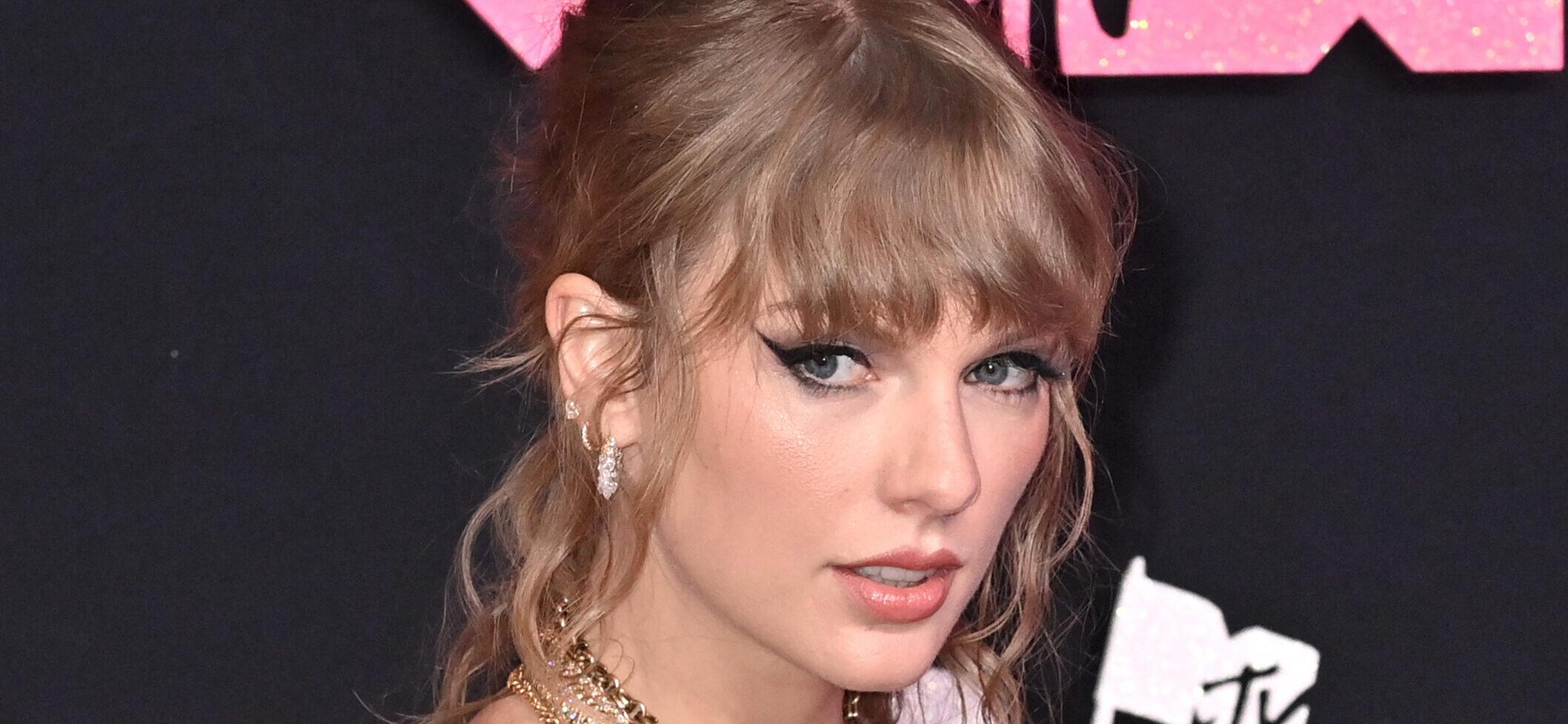

The rich seasonal owners of Rhode Island, especially Taylor Swiftare at the center of an animated controversy on a new tax targeting the second houses worth $ 1 million or more.

Nicknamed the “Taylor Swift Tax” by frustrated residents, the proposal aims to slap luxury owners with annual costs if their properties are not used for at least six months of the year.

The “Taylor Swift Tax”, included in the proposed budget of $ 14.3 billion in the state, sparked the reaction of celebrities, real estate agents and long -standing residents, with some threatening to completely abandon their summer pensions.

The article continues below the advertising

Taylor Swift could be affected by “Taylor Swift Tax”

Among the people in the reticle, there is itself Swift, which has a mansion by the sea of the sea of $ 17 million in the high-end seaside town of Watch Hill since 2013. Although intended to support affordable housing initiatives, criticisms argue that supplementation is an erroneous attempt to tighten longtime residents and seasonal visitors.

The backlash was fierce.

The owner of the local company James Nicholas, whose family managed the ice cream store of the beloved annex of St. Clair for four generations just at the bottom of the succession of Taylor Swift told Daily mail“” As one of the people who run small businesses who benefit from summer residents, I think of other landscapers, wooden yards, entrepreneurs, swimming pool companies that count on these summer visitors. “”

The article continues below the advertising

“It is not the golden ball that people think it is, that we are just going to send rich SMS and that nothing will happen. There are downstream consequences,” he continued. “There is a company stratum that can absorb this cost, but ordinary people, maybe they do not add to the house, don’t you know how to go to local restaurants, or they don’t shop in local stores, threw them, it’s a short view.”

Barstool Founding Sports Dave Portnoy Also weighed, warning that the tax could create a dangerous precedent across the northeast.

“We don’t like this tax,” said Portnoy in a video. “Now, I don’t have houses in Rhode Island, but I have become quite close. I don’t like these states get ideas.”

The article continues below the advertising

“ Taylor Swift Tax ‘could cost owners six figures

According to the proposal, the owners of secondary residences pay an annual supplement of $ 2.50 per $ 500 of value evaluated beyond the first million dollars. For the SWIFT manor and other areas of Watch Hill, this could mean annual six -digit costs.

But the real estate agent Larry Burns stressed that the tax will not only reach celebrities.

“There are people like Taylor Swift, people will look at her and think:” Well, she has so much money that she will never even notice an increase like this “,” said Burns. “But $ 100,000 here could be collegial studies for a year for a child, or two children. Not everyone has inexhaustible resources.”

The article continues below the advertising

Rhode Island real estate agents warn tourism

The budget also includes an increase of 63% of the tax on real estate transport, costs paid when the properties are sold, income from the two taxes allocated to affordable housing projects.

Local real estate agent Geb Masterson echoes concern, saying that it is “just another way to continue the rich when the funds of the state are dry … This is another nail in the coffin.”

He also said that many residents threatened to take their money elsewhere, and feared that local businesses, which are based on summer tourism, take a hit if the seasonal crowd begins to disappear.

The article continues below the advertising

The governor pumps the brakes (for now)

On Wednesday, the governor of Rhode Island, Daniel J. McKee, refused to sign or veto to the bill, criticizing the tax increases as useless.

“Right now, it was not necessary to increase taxes on anyone,” said McKee, although he has not completely excluded a future version of the bill.

The legislator can always revise the budget to obtain the approval of McKee, but for the moment, the tax remains in the limbo.

Inside the real estate empire of Taylor Swift

The Watch Hill manor of Swift is only a piece of its extent of the real estate empire.

In 2013, the global superstar bought the 5.25 acres Rhode domain for $ 17.75 million in an all-terrain agreement. The 11,000 square feet house includes seven bedrooms, nine bathrooms and more than 700 private beach feet, perched at the top of the highest of Watch Hill.

Beyond Rhode Island, Swift’s Real Estate Holdings Stretch Coast to Coast. She has two luxury condos in the Nashville music row district, a historic mansion in Beverly Hills, and several properties in the high -end Tribeca district of New York, including three combined units and an adjacent town house which she would have converted as a private entrance.

The article continues below the advertising

She would also have bought a mansion in the exclusive Northumberland Nashville field for her parents.

Whether the “Swift Taylor tax” is implemented or not, the controversy has already struck a nerve in the Rhode Island, revealing a deep gap between progressive objectives and economic reality in one of the most exclusive coastal enclaves in America.

Post Comment